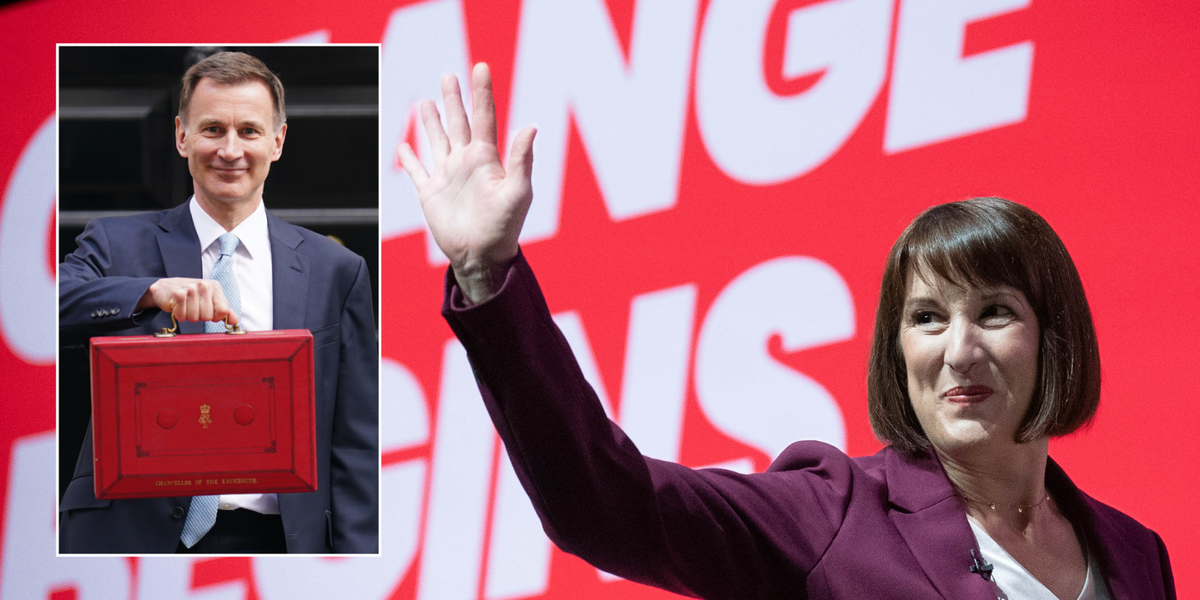

Chancellor Rachel Reeves’ Inheritance Tax Overhaul: What to Expect

As the UK grapples with a burgeoning financial crisis, Chancellor Rachel Reeves is preparing to unveil a budget that could significantly alter the landscape of inheritance tax. With the government facing an alarming "black hole" in its finances, Reeves is poised to increase one of the most contentious taxes in Britain. This article delves into the implications of these potential changes and explores the various strategies that could be employed to bolster the treasury’s coffers.

The Inheritance Tax Dilemma

Inheritance tax (IHT) is levied at a rate of 40% on the value of an individual’s estate exceeding the £325,000 threshold. Currently, this tax generates approximately £7 billion annually for the government. However, it has long been criticized for being anti-meritocratic and unfair, as much of the wealth accumulated over a person’s lifetime has already been taxed. Critics argue that taxing wealth again upon death disproportionately affects hard-working families, particularly those who may not consider themselves wealthy but own property or have savings that push them over the threshold.

The Financial Context

The urgency of Reeves’ proposed changes stems from a recent assessment that revealed a staggering increase in the government’s financial shortfall—from an initial estimate of £22 billion to a projected £40 billion. This alarming trend has prompted Reeves to warn that the UK could face a £100 billion black hole in its finances over the next five years. In light of these figures, the Chancellor has indicated that "tough decisions" will need to be made, with a focus on increasing taxes rather than cutting public spending.

Potential Changes to Inheritance Tax

In response to the financial crisis, Reeves is expected to implement a series of reforms aimed at increasing revenue from inheritance tax. Here are five potential changes that could be on the table:

1. Crackdown on Gifting

Currently, individuals can gift up to £3,000 per year tax-free, but numerous loopholes exist that allow wealthier individuals to transfer assets without incurring tax liabilities. For instance, those with surplus income can give away unlimited amounts as long as it does not affect their living standards. Experts predict that Reeves may seek to tighten these rules, potentially introducing a fixed annual limit on tax-free gifts, thereby closing the loopholes that allow for significant tax avoidance.

2. Scrapping Business Relief

Business relief currently allows individuals to inherit businesses without incurring inheritance tax, saving families approximately £1.4 billion annually. Reeves could consider reforming this relief by introducing capital gains tax on the sale of inherited businesses or limiting the number of business assets that can be passed on tax-free. Such changes could generate significant revenue for the treasury while ensuring that inherited wealth is taxed more equitably.

3. Targeting Pensions

Under current regulations, pensions can be inherited tax-free, incentivizing individuals to accumulate wealth in their retirement accounts with the intention of passing it down to their children. The Institute for Fiscal Studies has suggested that abolishing this tax exemption could yield an additional £1-2 billion for the government by the end of the decade. This move could be particularly controversial, as it would directly impact the financial planning of many families.

4. Ramp Up Investigations

There is a growing suspicion that many middle-class families with assets exceeding the inheritance tax threshold are underreporting their wealth or evading taxes altogether. This often occurs when families undervalue their properties to avoid the taxman. The Labour Party has pledged an additional £855 million for HMRC to combat tax evasion, and it is widely anticipated that Reeves will prioritize investigations into these families as part of her strategy to recover lost revenue.

5. Removing Capital Gains Relief

Currently, capital gains accrued up to the date of death are exempt from taxation, providing families with significant savings when a loved one passes away. If Reeves were to eliminate this relief, families could face a combined effective tax rate of 55% when accounting for both inheritance tax and capital gains tax on the sale of inherited assets. This change would undoubtedly provoke strong reactions from the public and could be seen as a double taxation on wealth.

Conclusion

As Chancellor Rachel Reeves prepares to unveil her budget, the proposed changes to inheritance tax are likely to spark intense debate across the political spectrum. While the need for increased revenue is clear, the implications of these reforms could have far-reaching effects on families across the UK. As the government seeks to address its financial challenges, the balance between fair taxation and the preservation of family wealth will be a critical consideration. The coming weeks will reveal how Reeves navigates this complex landscape and what it ultimately means for the future of inheritance tax in Britain.